L’Rise — an automated information system for servicing individuals

The system is designed to automate retail business processes of a commercial bank and provides the bank with ample opportunities for customer service, flexible settings and automation of mass processes, prompt data analysis

Module Benefits:

The system consolidates all data into a unified space, enabling seamless integration and instant access to information

- Single centralized customer database

- Unified information system across all sales channels

- Three-tier architecture (database server, application server, user workstation)

- Secure storage of system user credentials

- Modern and reliable DBMS (Database Management System)

- Separation of front-office and back-office functions

L’Rise Functional Capabilities:

Module “Current Accounts and Deposits”

Functional complex for conducting all operations on servicing deposits and current accounts of individuals

Module advantages:

Functionality of the “Current Accounts and Deposits” module

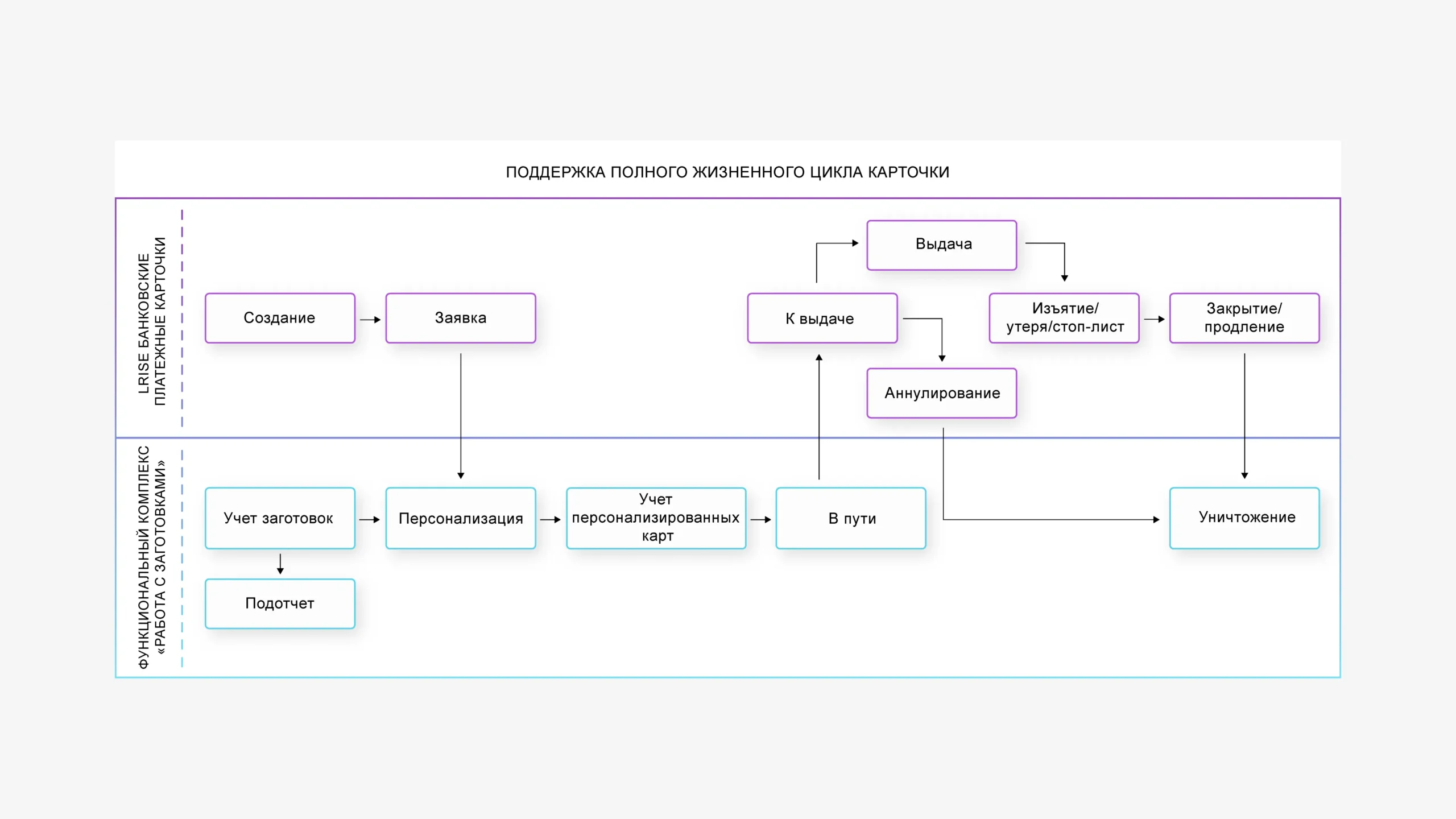

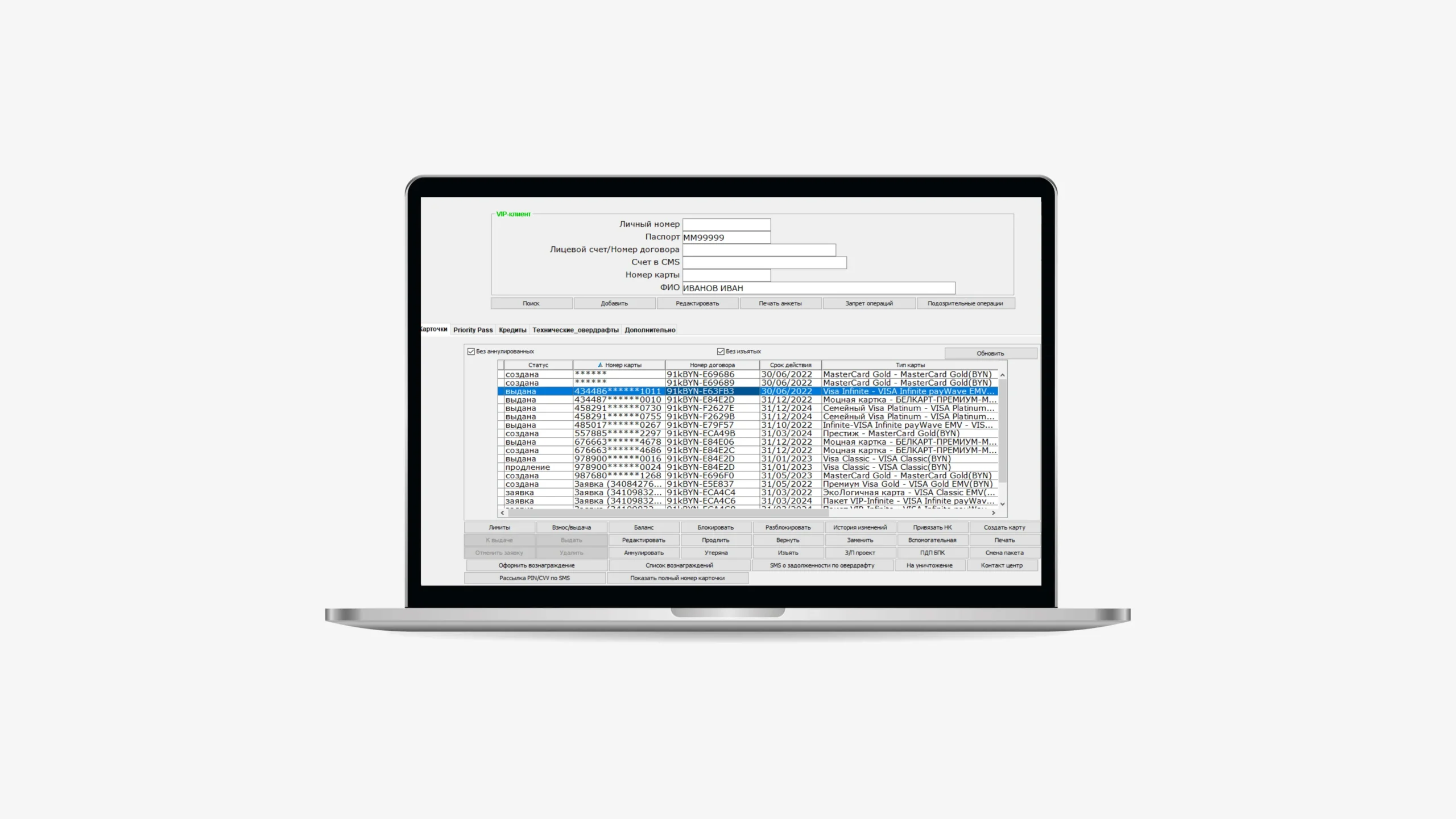

Module “Bank Payment Cards”

Module for card issuance, account management and cards, transaction processing, payments

Module advantages:

Functionality of the “Bank Payment Cards” module

Used Online interfaces protocols:

- POS Terminals based on ISO 8583:1993,

- Native ISO 8583:1993(E)

- Symbols Version 4.2.13

- POS Concentrator terminals 1.06.09

Module “Operational Cash Desk”

Full range of operations with cash, precious metals, coins and precious stones: from accepting any type of payment to buying diamonds

Module advantages:

Functionality of the “Operational Cash Desk” module

Registering transactions at the cash desk:

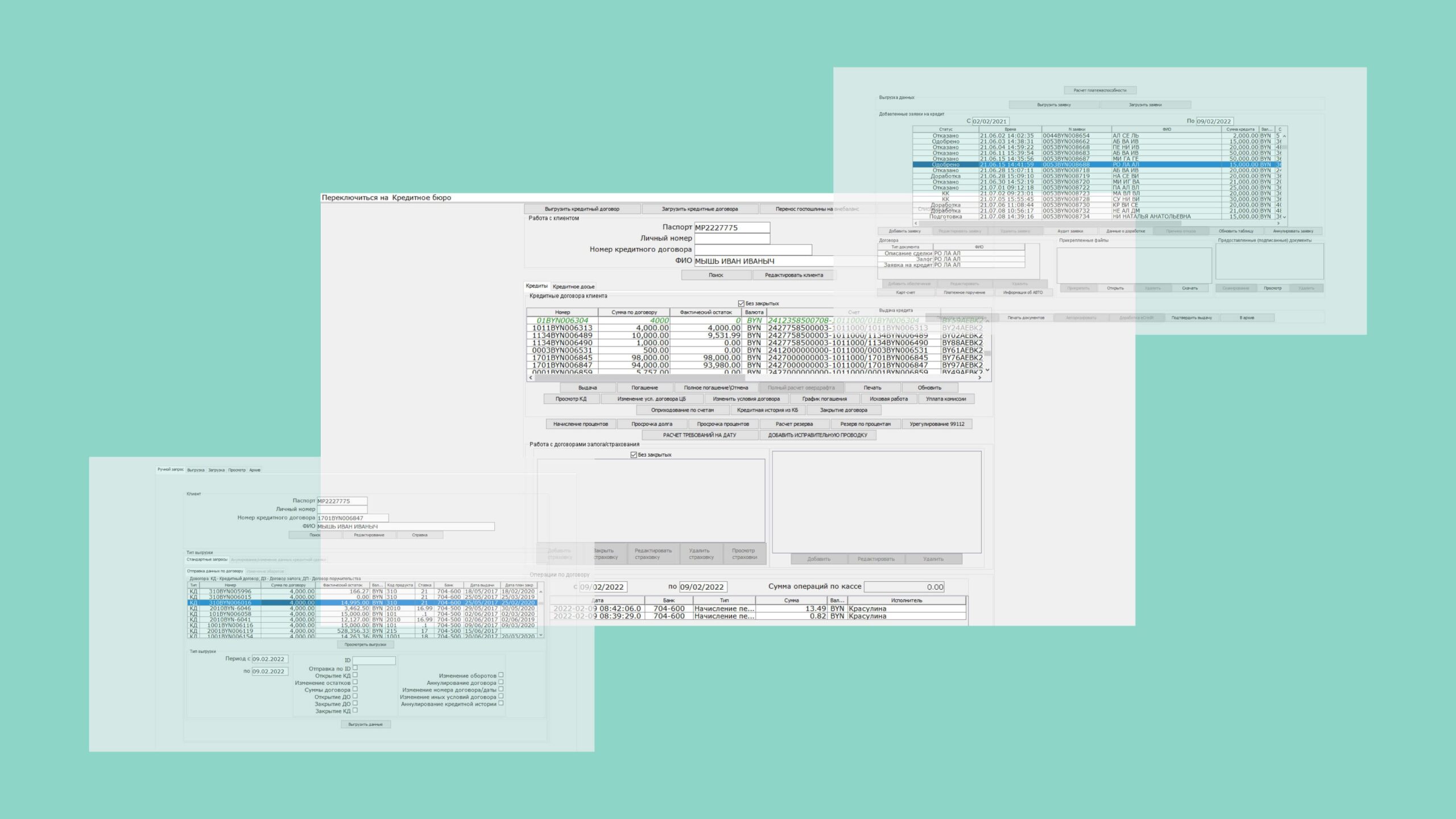

Module “Loans”

Processing and reviewing loan applications, full loan maintenance cycle from application to closure

Advantages:

Functionality of the “Loans” module:

L’RISE system functional complexes

Want to discuss a joint project?

Be our partner and together we will achieve your expectations