Project for Belgazprombank – Functional development and support of various systems

Development, Functional Enhancement, and Support of Cash Circulation Management Systems, Electronic Banking Document Management, and Corporate Foreign Exchange Trading Platform

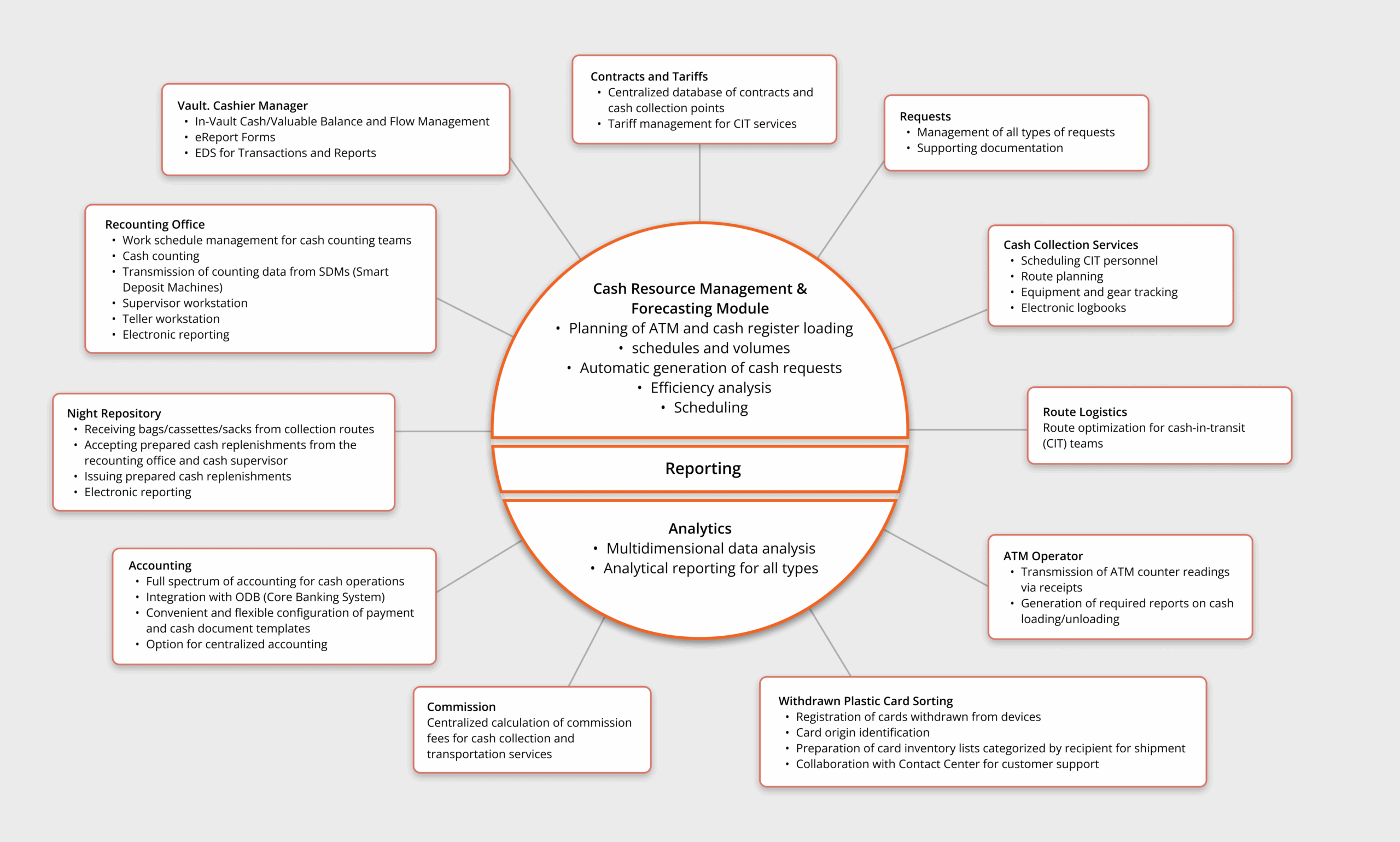

Unified Bank Cash Circulation Management Platform

Key Functional Modules:

- Planning ATM and cash register replenishment schedules and amounts

- Automatic generation of requests

- Accounting of cash balances and movement of valuables

- Electronic reporting with digital signatures

- Signing of transactions and reports using digital signatures

- Cash acceptance and dispensing, route processing

- Counting, control, and document processing

- Full cycle from cash replenishment to reporting

- Centralized tracking of all requests

- Database management of contracts, tariffs, and collection points

- Planning of CIT routes and schedules

- Equipment tracking and maintenance of electronic logs

- Recording ATM cash loading/unloading based on counter readings

- Registration and allocation of withdrawn banknotes

- Generation of supporting documentation

- Integration with ATM service providers

- Integration with accounting systems

- Centralized document template management and customization

Additional Features:

Centralized storage and request management

Full automation of all cash handling processes

Forecasting and optimization of cash replenishment

Increased efficiency of CIT and cash register operations

Advantages of the system:

Key Outcomes

- Improved security and manageability of cash circulation

- Reduced manual operations and planning time

- Full compliance with internal control and regulatory requirements

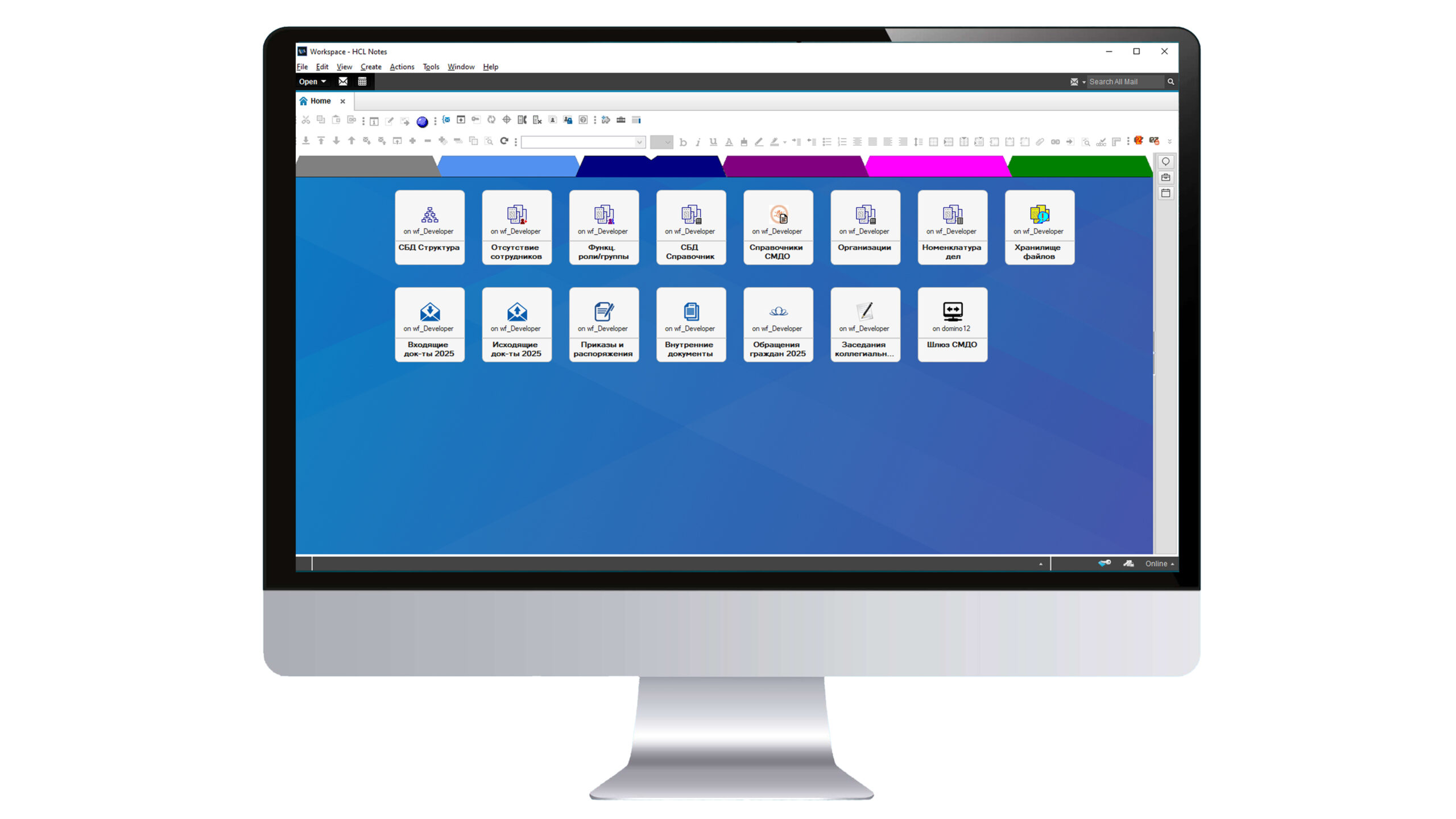

Electronic Banking Document Management System

Key Functional Modules:

- Integration with the State Interagency Document Exchange System (GSMDO)

- Legally binding exchange with digital signature via the State System for Management of Public Keys for Electronic Digital Signatures Verification

- Full coverage of all areas of the bank’s operations

- Automated approval and execution workflows

- Agenda creation and extract preparation

- Online voting (Management Board, Main Credit Committee, etc.)

- Legally binding documentation of resolutions

- Acts, transfers, relocations, and other corporate processes

- Complete electronic cycle from creation to archiving

Automated processing and execution control

Additional Features:

Integration with electronic archives – secure storage and fast document retrieval

Legal validity of all operations via the State System for Management of Public Keys for Electronic Digital Signatures Verification

Improved efficiency and transparency of document management

Advantages of the system:

Key Outcomes

- Digital transformation of the bank’s document workflow

- Reduced document processing times

- Full compliance with regulatory requirements

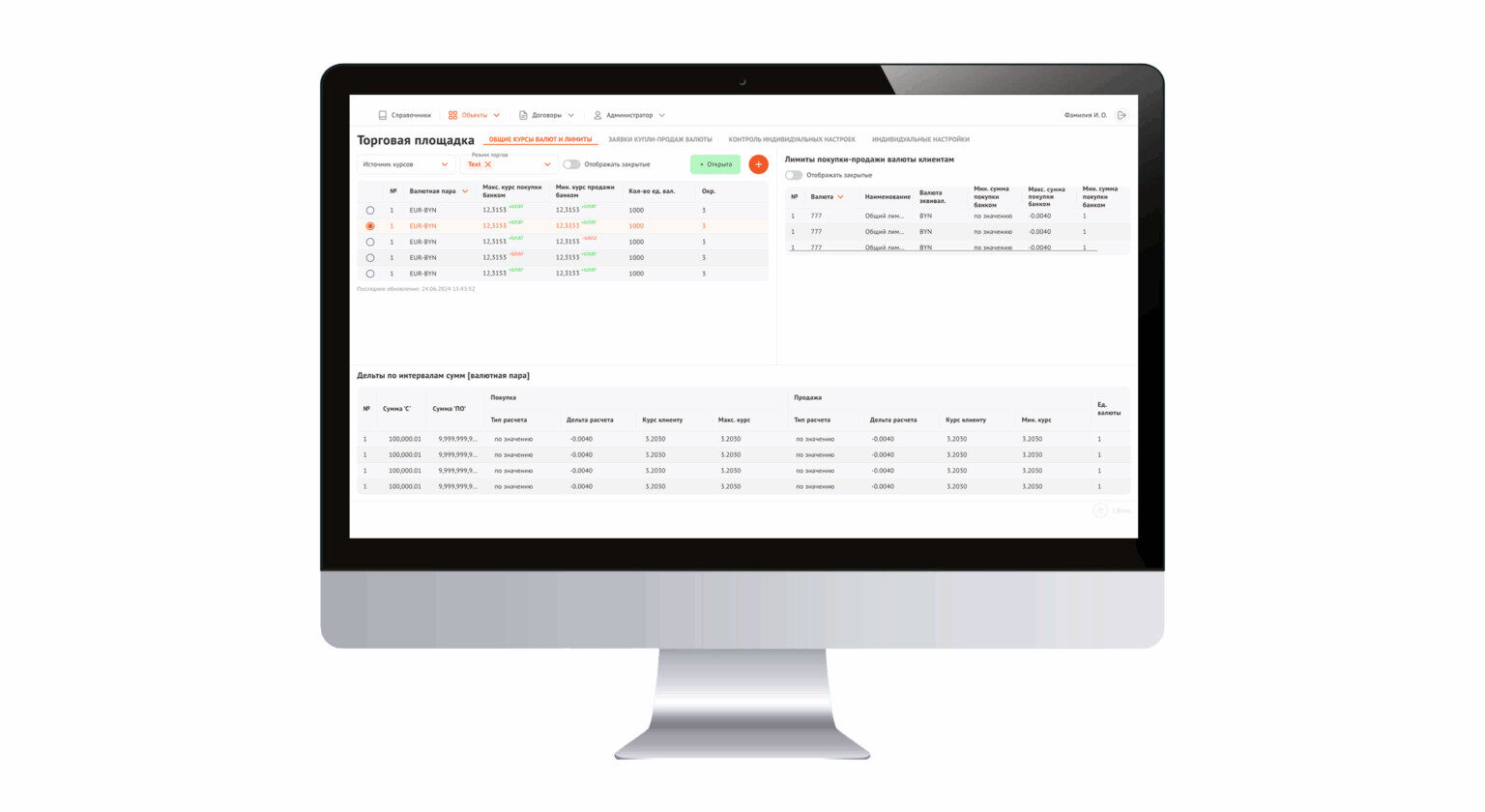

Trading Platform

Display of the bank’s exchange rates (importing rates from bank files, integration with liquidity providers)

Execution of transactions (TOD, TOM, SPOT, SWAP) (buy/sell/conversion) at the bank’s rates

Execution of transactions at individual rates (initiated by the client or by the bank)

Limit control / Group settings / Individual settings

Execution of transactions at rates of Belarusian Currency and Stock Exchange, JSC (BCSE)

Monitoring of currency positions and financial results from client transactions

Automated closure of deals with liquidity providers

Advantages for the bank:

Flexible, centralized mechanism for setting exchange rates

Streamlined internal banking processes related to foreign exchange operations

Implementation of an individual loyalty system without client manager involvement

Real-time response to changes in currency quotations

Want to discuss a joint project?

Be our partner and together we will achieve your expectations