Want to discuss a joint project?

Be our partner and together we will achieve your expectations

It is designed to provide the bank’s management and employees with the necessary information for conducting analysis in various areas of activity and making informed management decisions

This is the main tool for generating both mandatory reporting to the National Bank of the Republic of Belarus, developed in accordance with current regulations, and internal mandatory reporting that allows analyzing the state of activities of all the bank’s divisions according to pre-established uniform algorithms

The functional complex is intended for timely preparation of:

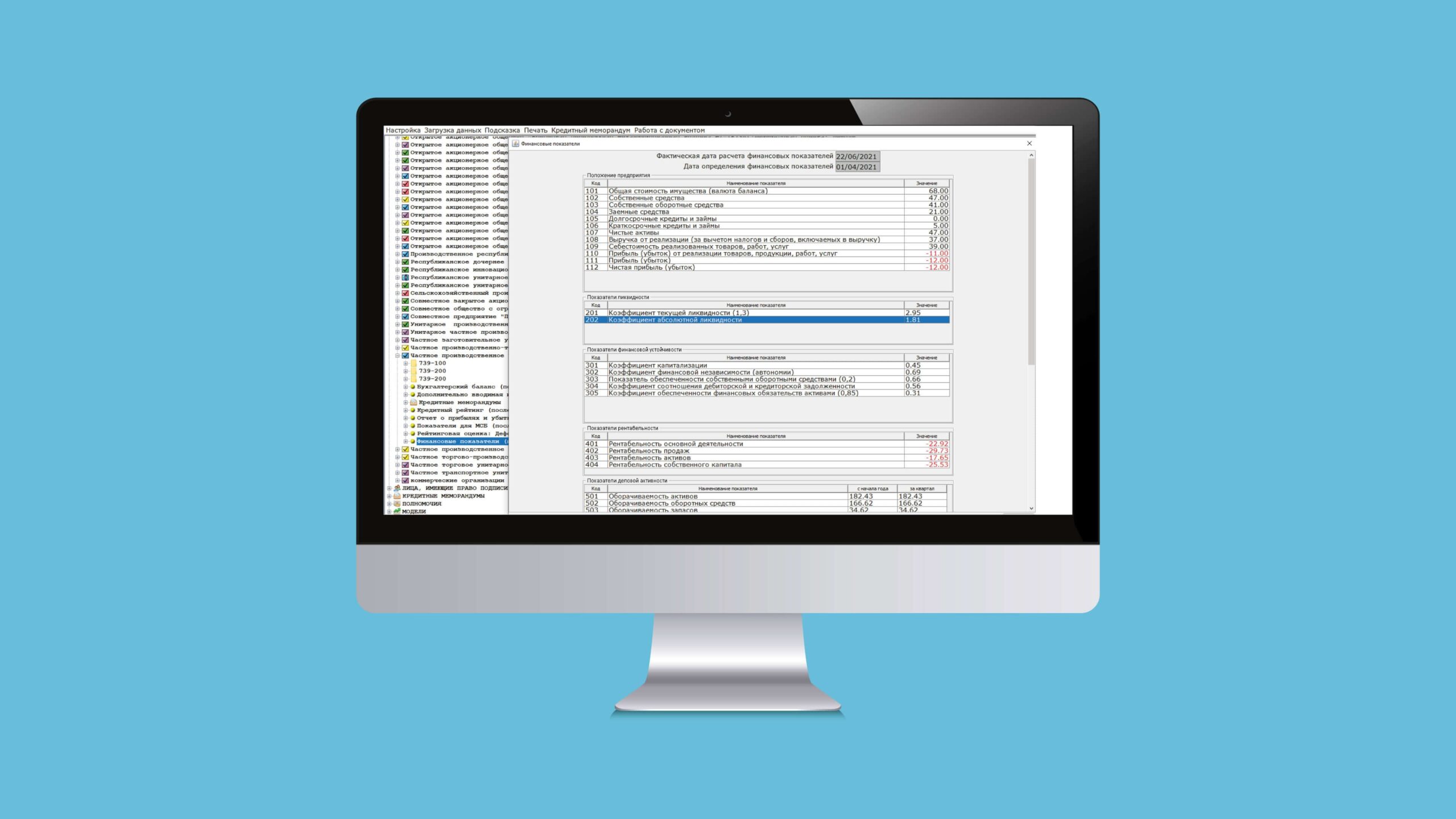

Designed to automate the process of determining the rating assessment of the financial condition of legal entities in order to assess the degree of risk associated with the level of solvency of a legal entity when performing active lending operations

The functional complex is designed to implement a unified methodology for evaluating customers and conducting an in-depth analysis of the bank’s client base (for corporate clients) taking into account existing and developed banking products and the existing bank remuneration system for products (services) provided to clients

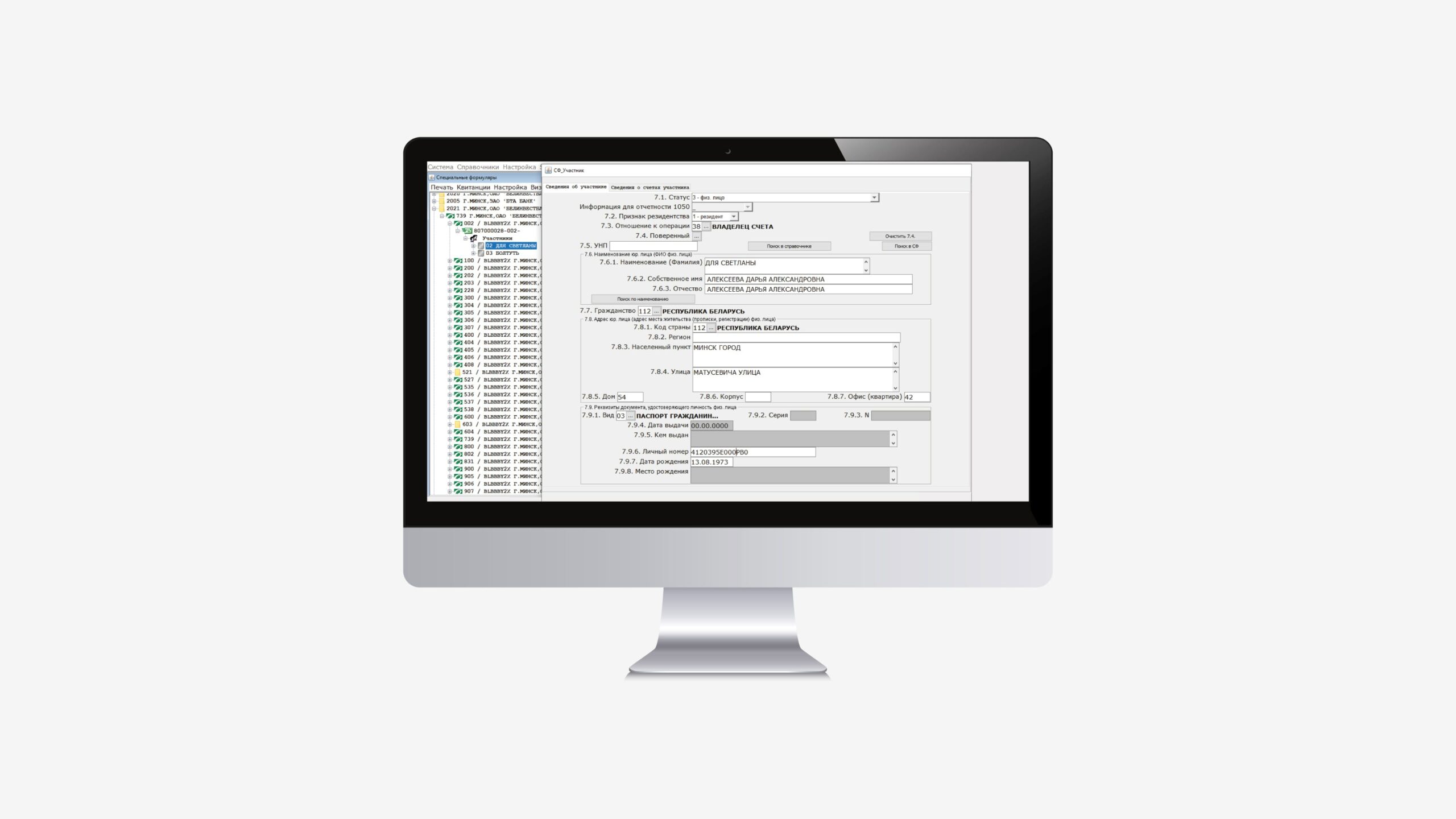

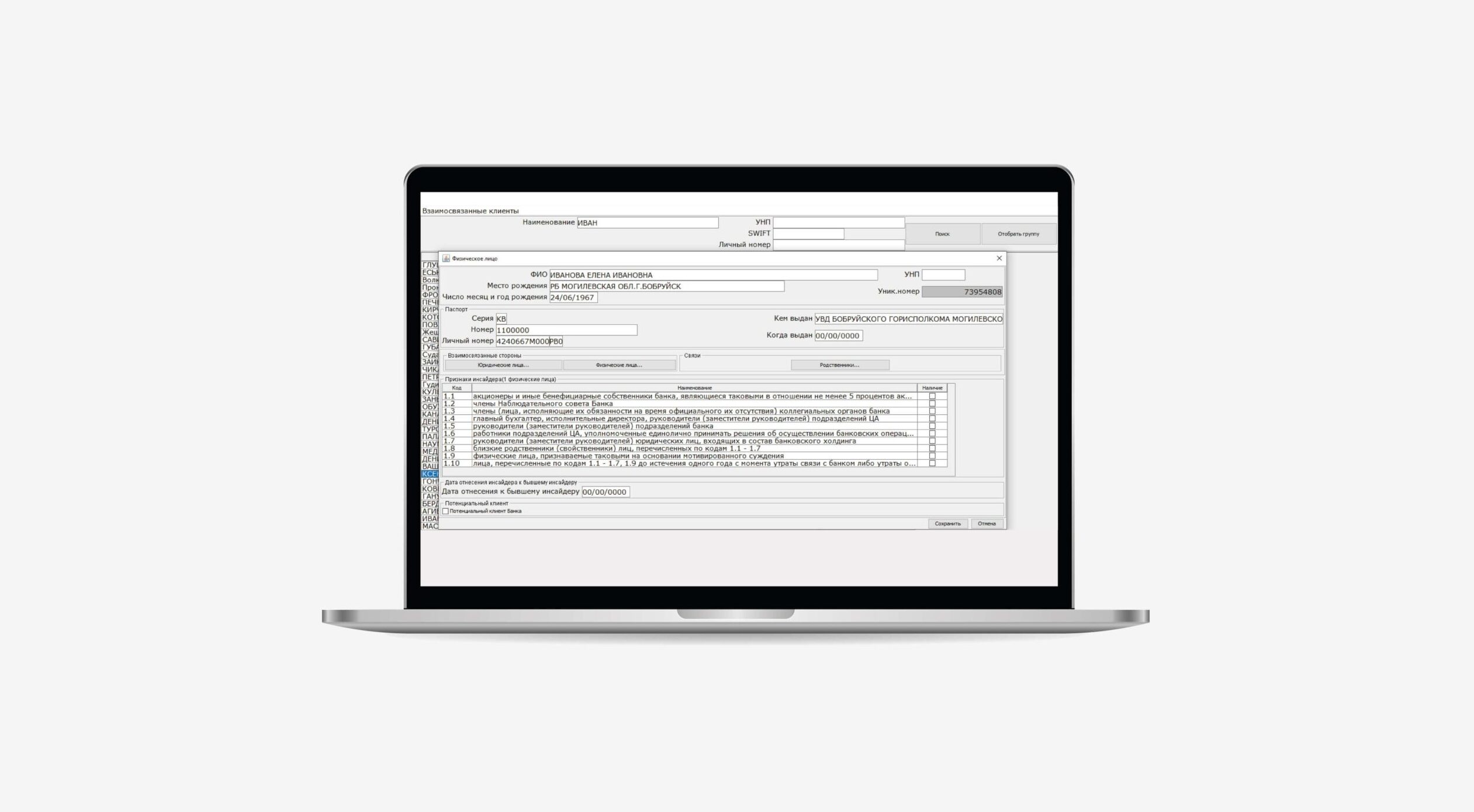

Designed to maintain personal data on clients and relationships between them, as well as to view relationship diagrams between clients within established groups

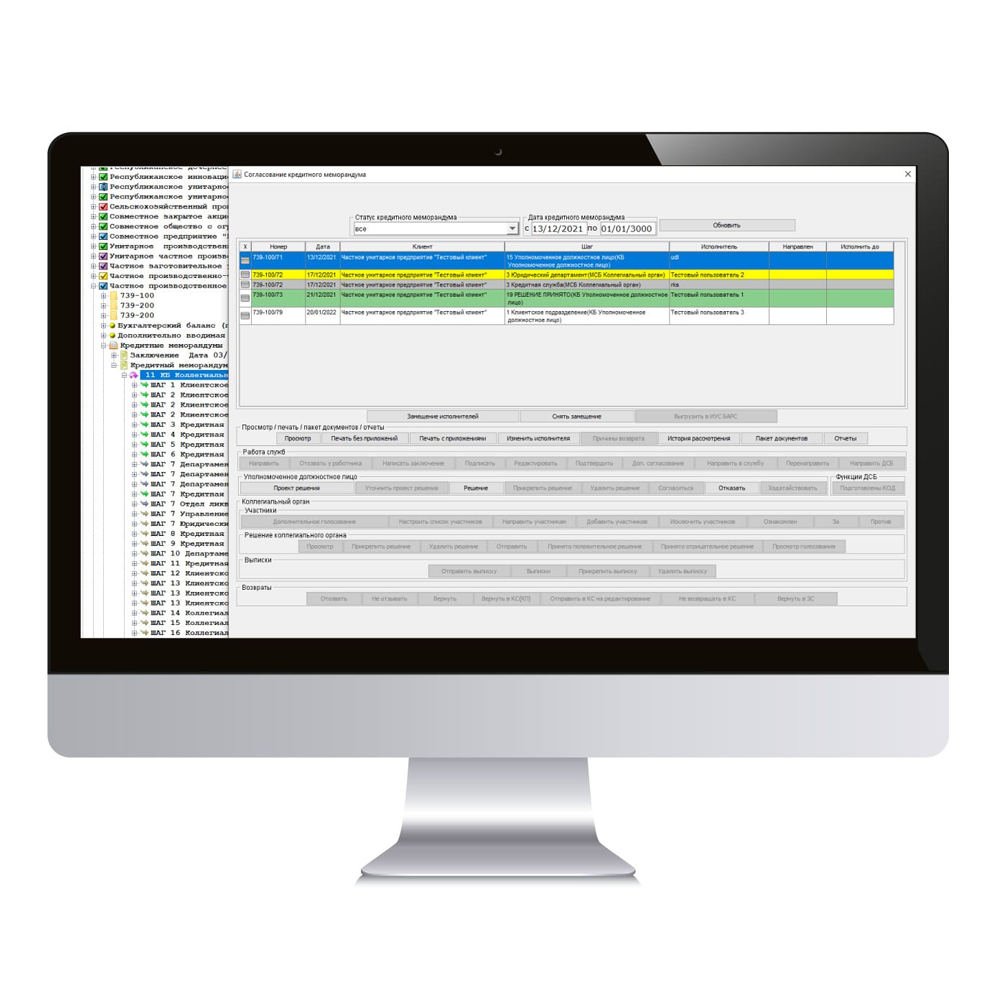

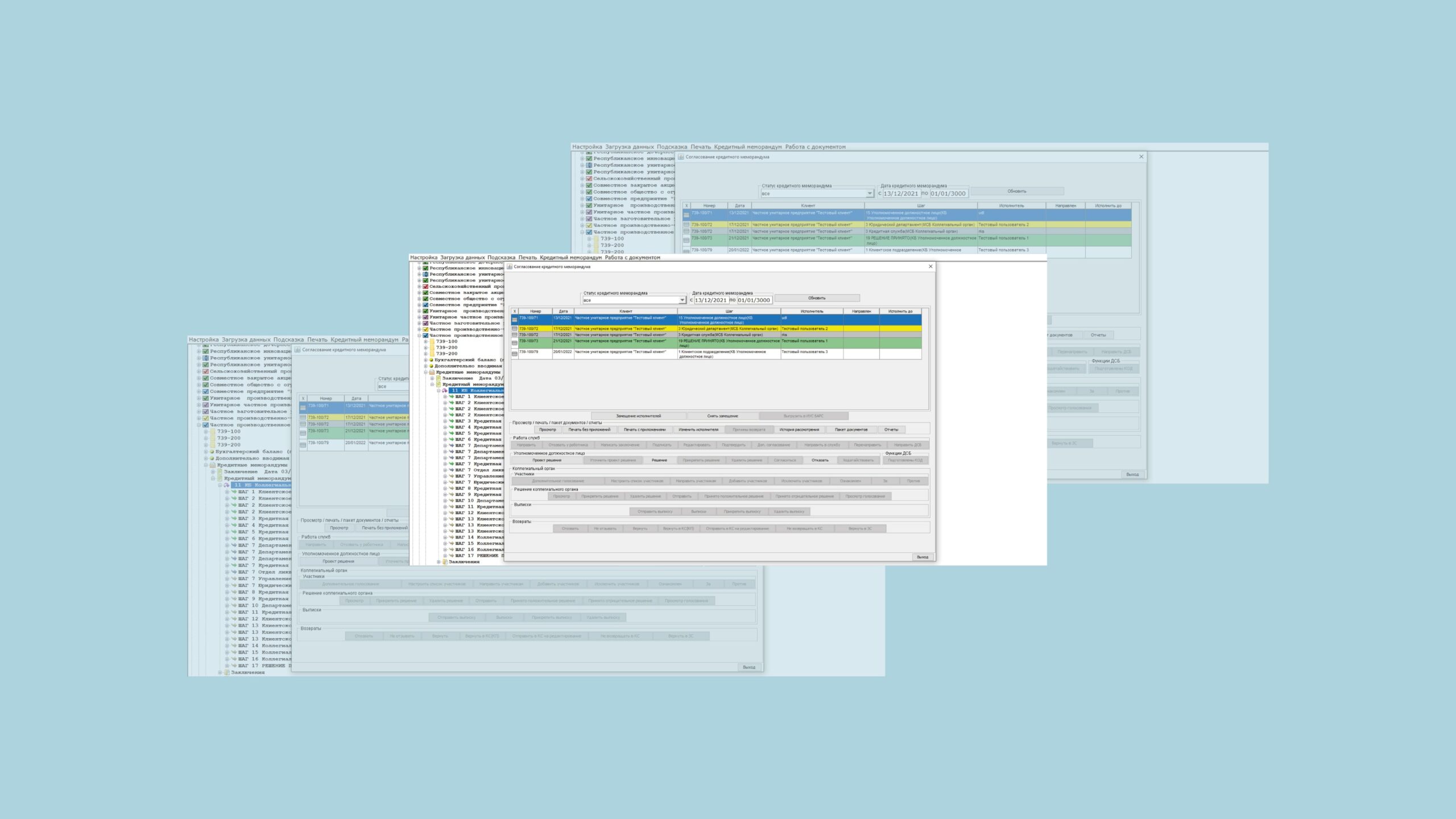

Designed for automated filling, consideration and approval of the “Credit Memorandum” document (for legal entities and individual entrepreneurs)

Designed to maintain clients who have carried out suspicious transactions, with subsequent sending of information about them to the Financial Monitoring Department. Generating reports on special forms and suspicious transactions