L’Sinore — Personal Credit Scoring

Credit scoring for personal loan applications, based on the bank’s history and credit registry data. Built-in risk assessment algorithms reduce the likelihood of defaults, optimize borrower verification costs, and ultimately increase loan issuance volumes with confidence in their reliability

Advantages of L’Sinore:

- Separation of front-office and back-office functions

- Credit risk level management

- Reduced decision-making time

- Decreased staff numbers

- Management of loan portfolio growth volume

- Avoidance of subjective decision-making errors

- Product multimodality

- Ability to use scoring for marketing and business purposes

Functional capabilities:

Assessing the risk of default by a potential borrower when issuing loans, based on the profile (portrait) of previously issued loans

Using the bank's historical data and other available databases (Ministry of Internal Affairs, Housing and Utilities, etc.)

Evaluating a single borrower using different models within one system

Reporting on Model Configuration, Validation, and Operation

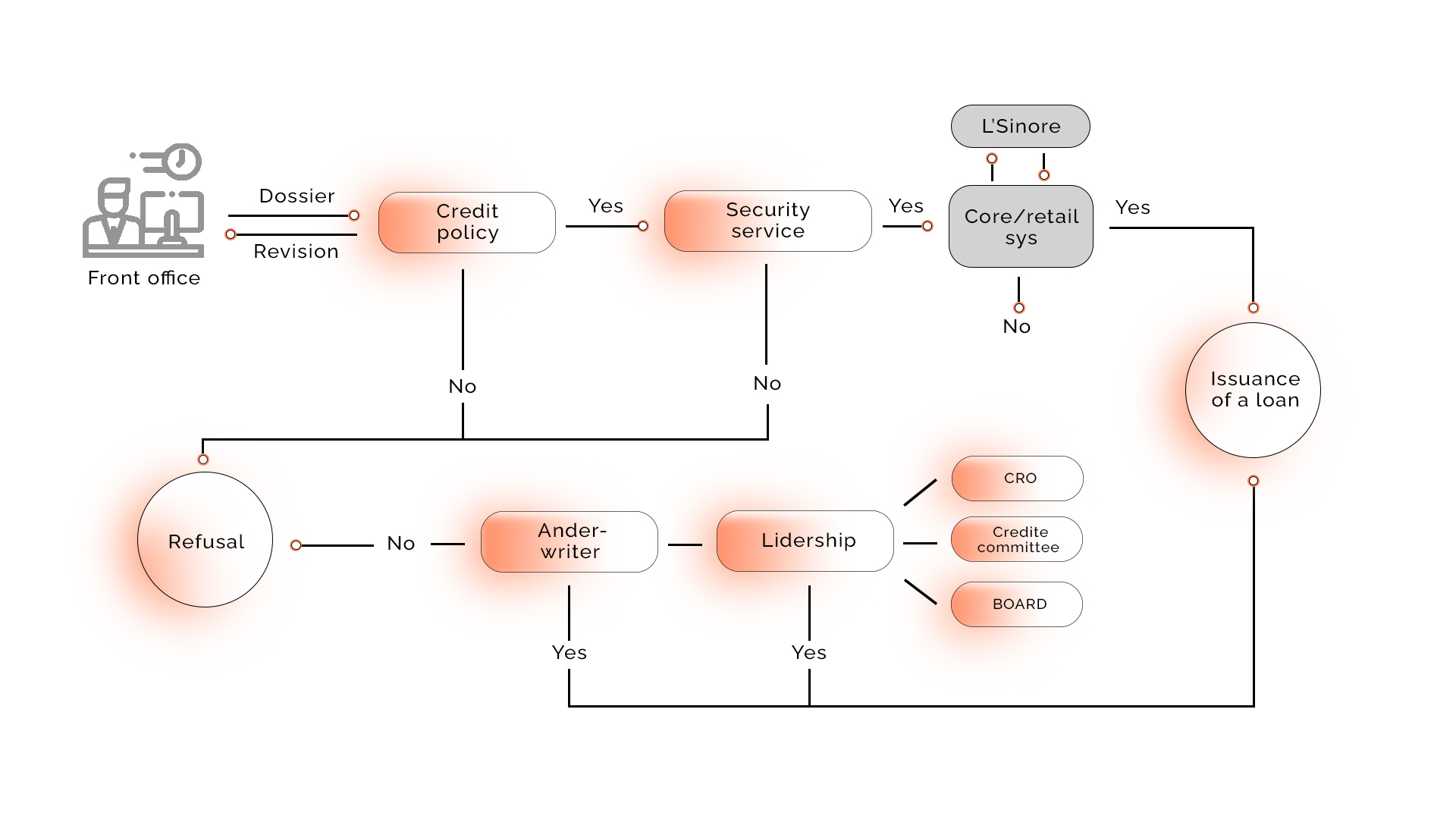

Decision-Making Business Process with Scoring

Flexible Settings:

Default Events (customizable for each model)

Input Model Parameters (adding/removing indicators and their gradations as needed; simple and complex indicators; indicator builder)

Neural Network (number of iterations, neurons in the hidden layer)

Outcomes (quantity and variations)

Training and Test Samples (templates)

Want to discuss a joint project?

Be our partner and together we will achieve your expectations