Project for Belinvestbank – Functional development and support of the bank’s operational systems

The project is developed for the functional development and support of the bank’s operational systems for individuals and legal entities, cash management, remote banking services systems, electronic document archives, and other banking products

L’Rise

Automated information system for retail customer service

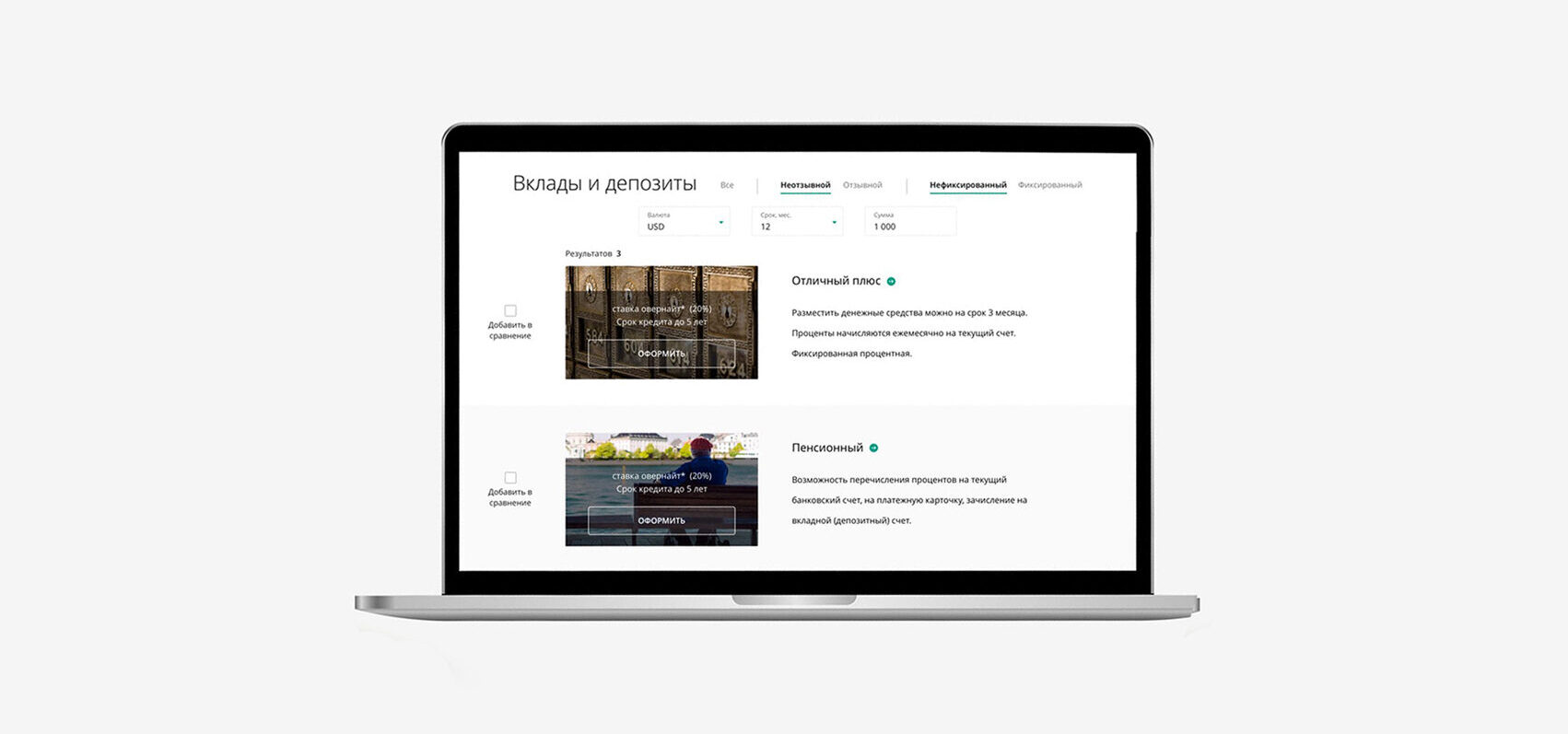

Marketplace

A platform specializing in the sale of banking products

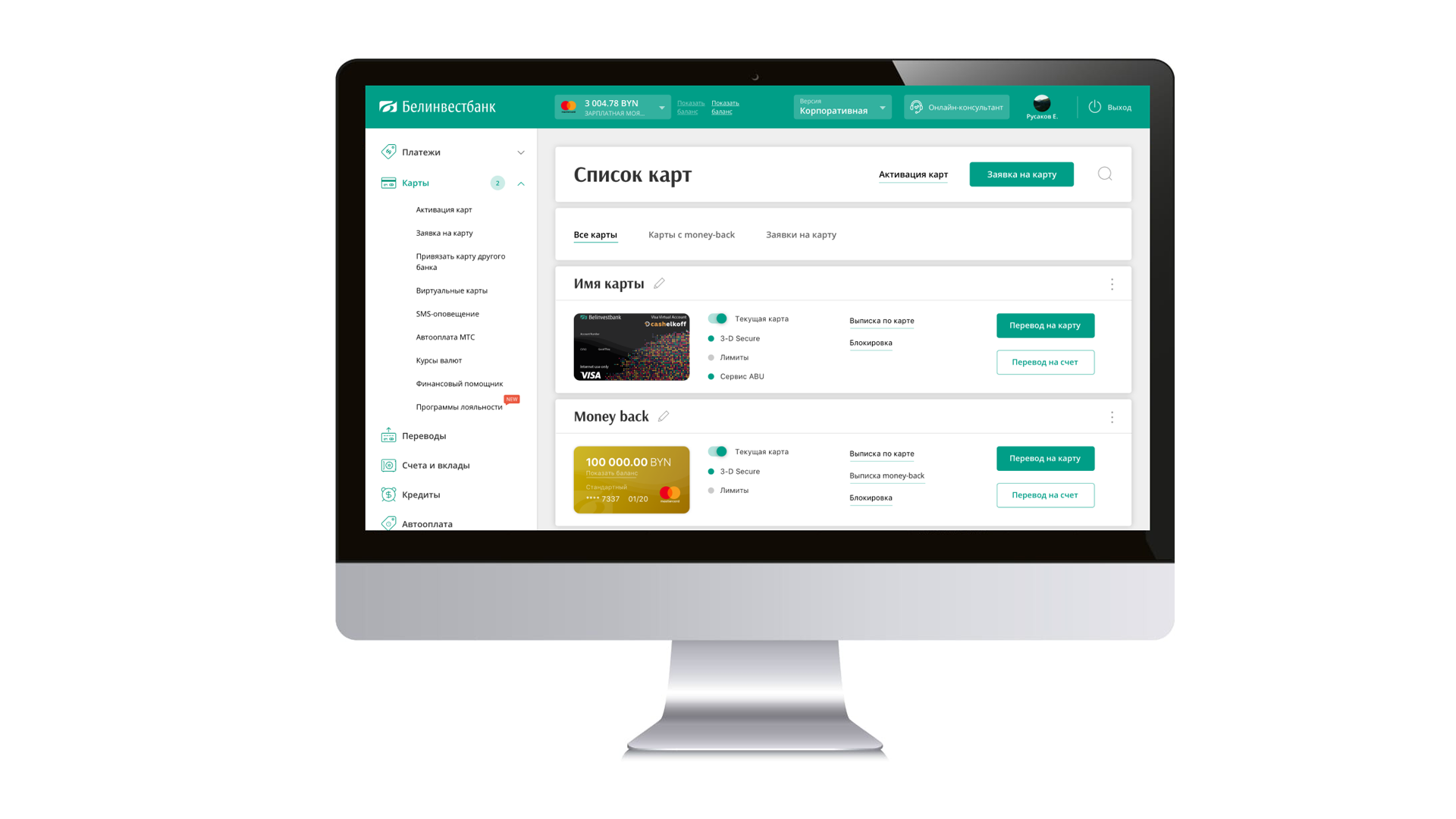

Money-back

Cashback Calculation Module Based on Card Transactions

Internet Banking for Individuals

Remote banking system using the Internet

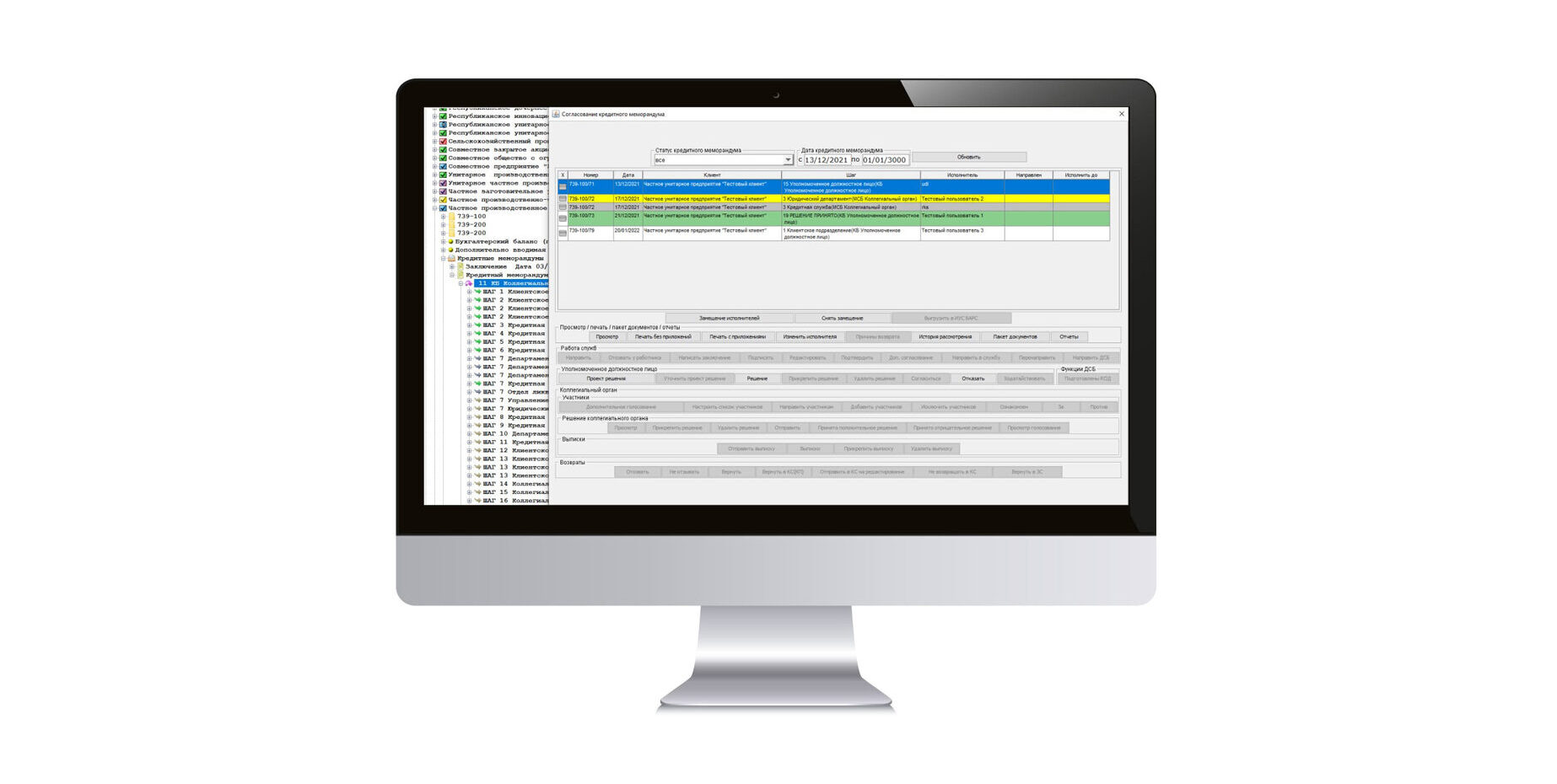

L’Brus

Software suite for information support of the bank’s corporate business

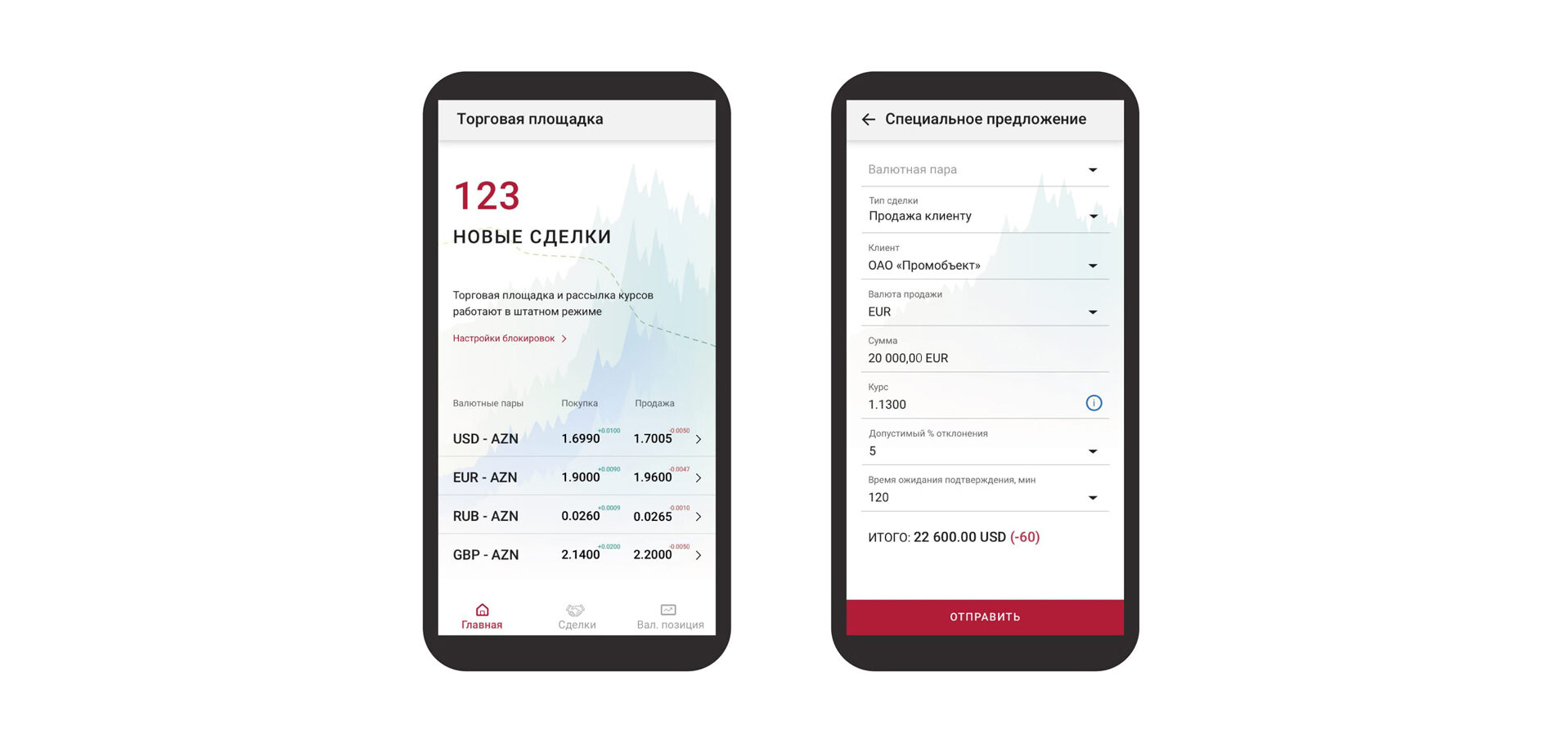

Currency Trading Platform

An effective tool for remote interaction in currency exchange transactions

L’Q

Analytical system for the banking sector

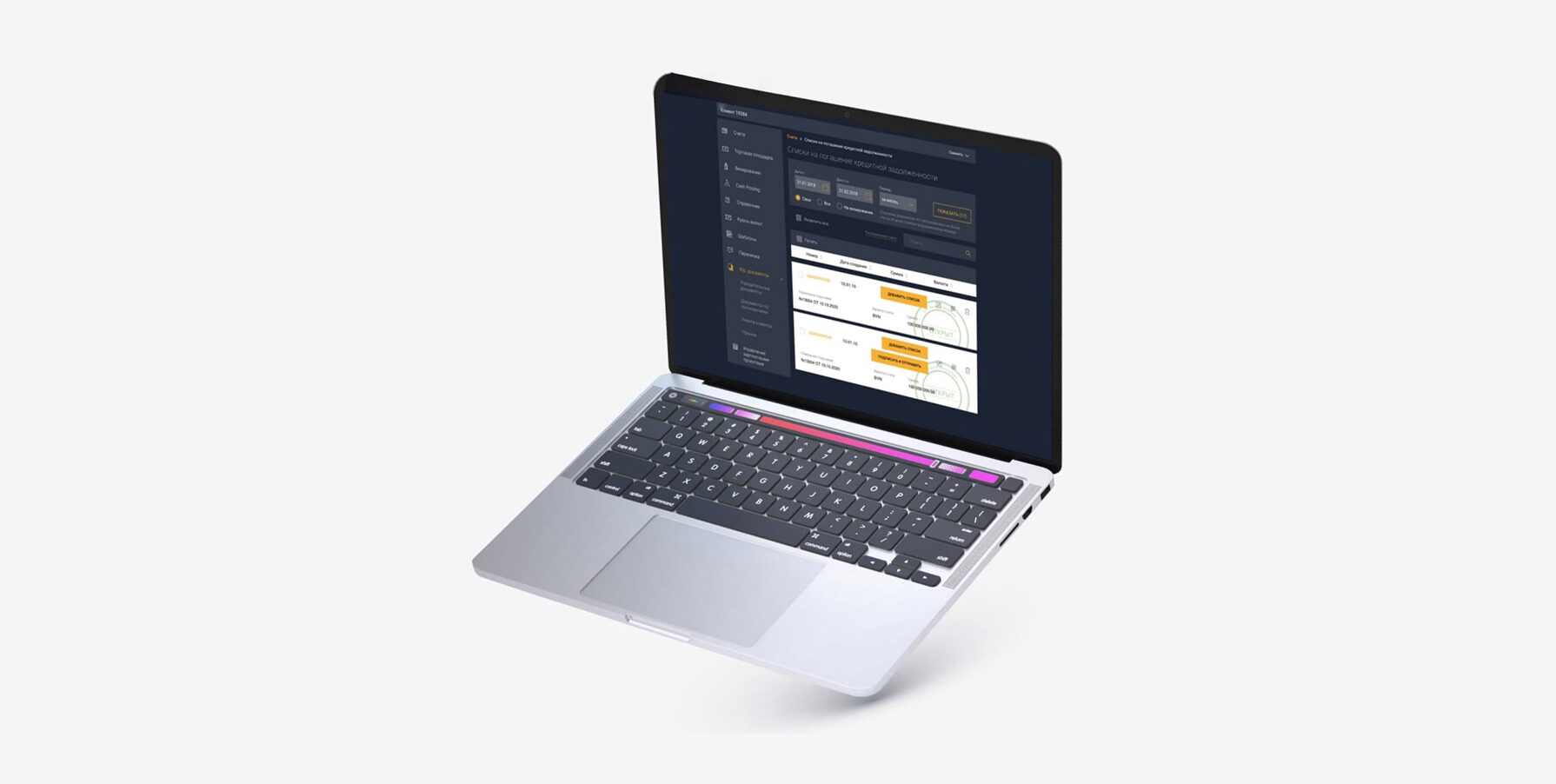

Internet Banking for legal entities and individual entrepreneurs

Internet-based remote banking service system

CRM System

Automation of Customer Interaction Processes

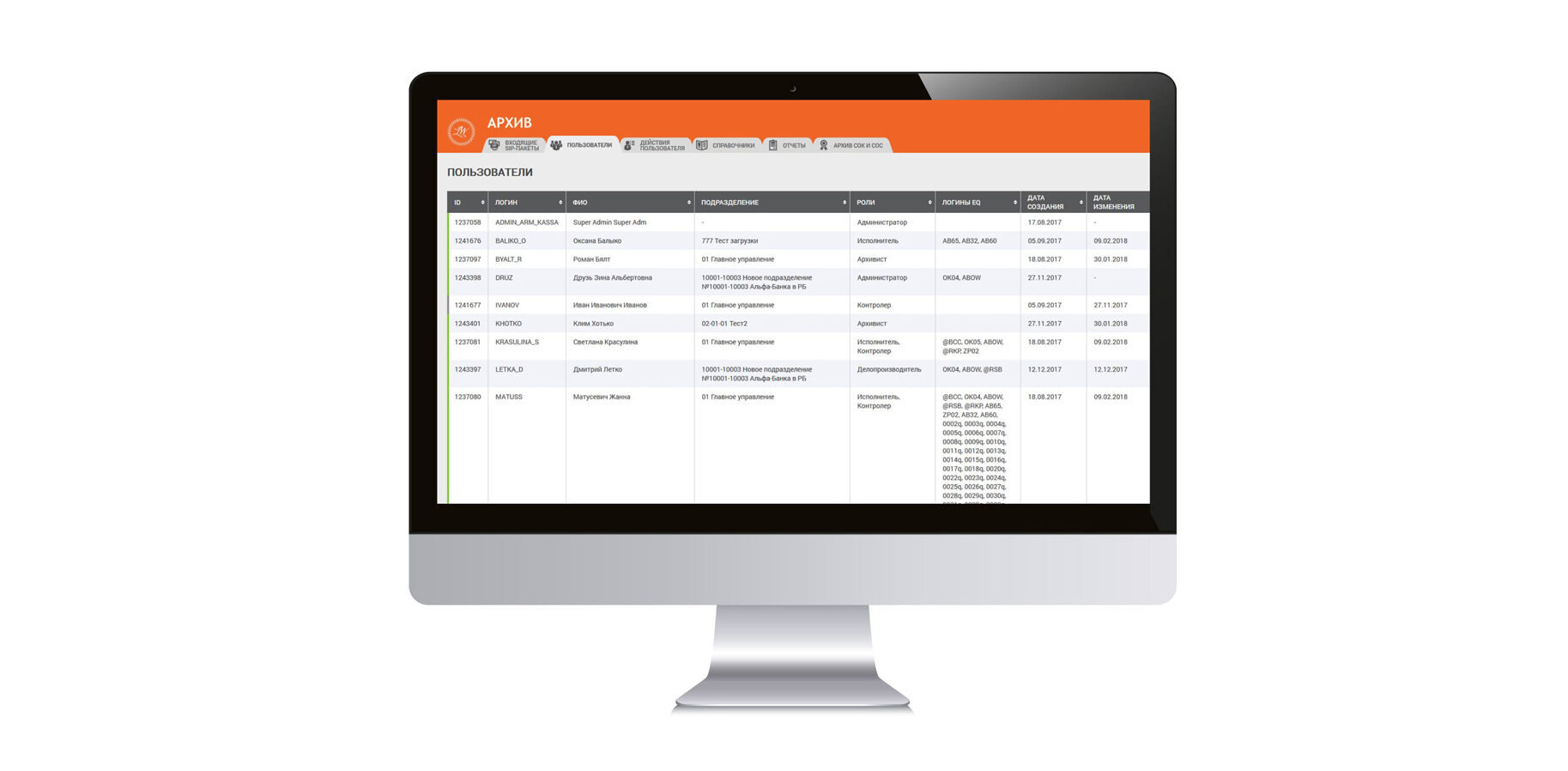

L’arch

Automated “Electronic Document Archive” system

Want to discuss a joint project?

Be our partner and together we will achieve your expectations