Project for Paritetbank – Functional development and support of remote banking service systems

The remote banking products developed for Paritetbank have been operating successfully since 2019, providing all necessary services for full-fledged servicing of legal entities and entrepreneurs. The functionality of remote banking is continuously evolving, enhancing the system with new features based on client needs

Functional Capabilities of the System:

Flexible Access Settings: Users can independently configure access levels for managers, deputies, and accountants

Account and Payment Management: View and monitor accounts via the mobile app, create, authorize, and execute payments, as well as conclude foreign exchange transactions through the built-in trading platform

Payment Automation: Analysis of recurring payments (up to 5 per month), payment templates based on previously executed transactions, and payment signing using multi-factor authentication

Electronic Client Dossier:

- Charter / Foundation Agreement

- Certificate of Registration

- Documents Confirming Authorizations

-

For Clients: Viewable in the remote banking system (RBS)

-

For Bank Employees: Quick access for work-related tasks

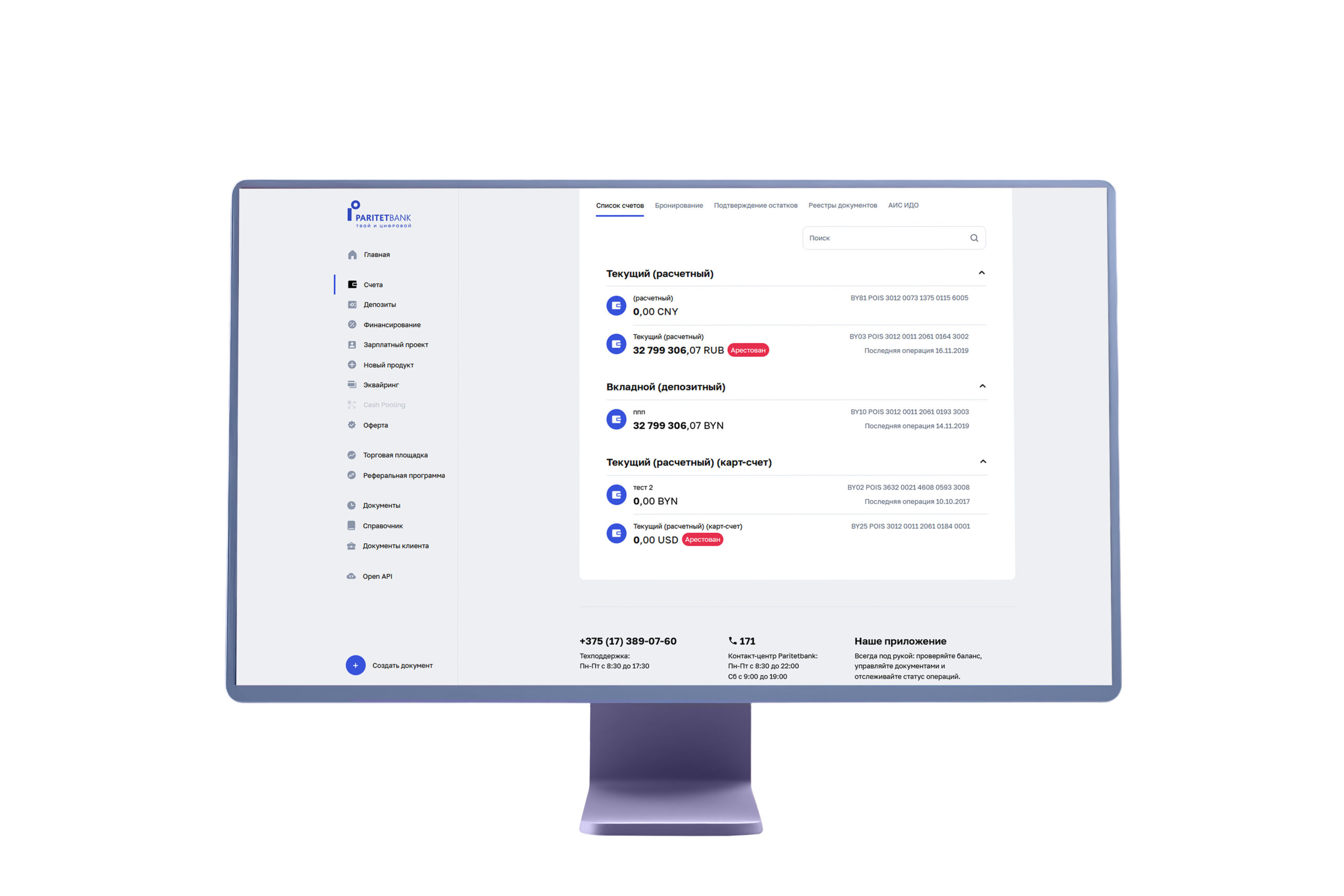

Home Page:

Account Overview: Displays balances, account statuses, and any restrictions

New Document Creation: Ability to create documents directly from an account

Statement Generation

Document Import: Supports importing from external systems

Quick Organization Switching: Seamless transition between different entities

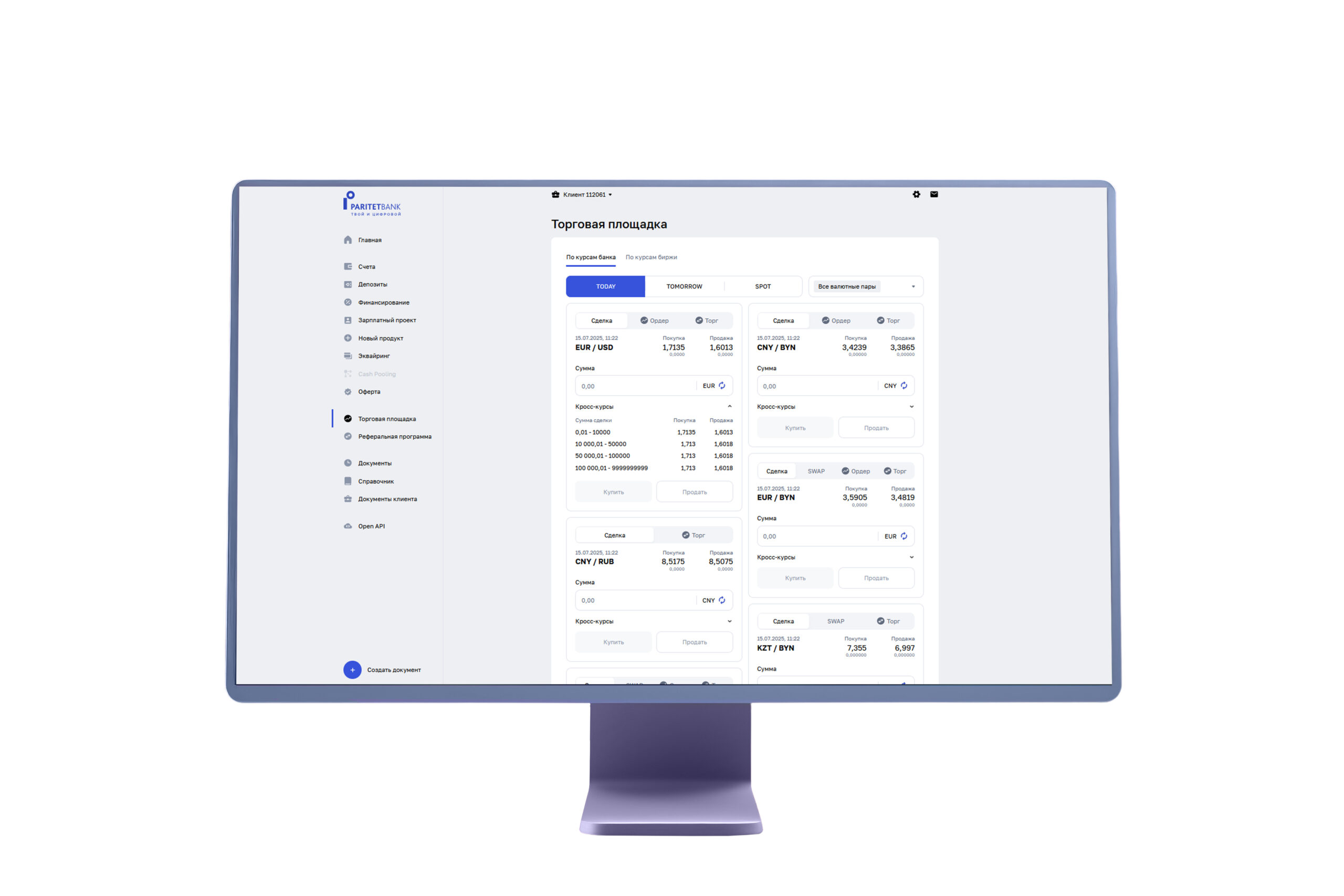

Trading Platform:

Real-Time Exchange Rate Tracking

FX and Conversion Transactions: Execute deals without visiting the bank

Simplified Deal Execution & Document Preparation

Best Deal Conditions: Automatic selection of optimal rates

Custom Quote Requests: Option to negotiate and receive personalized quotes

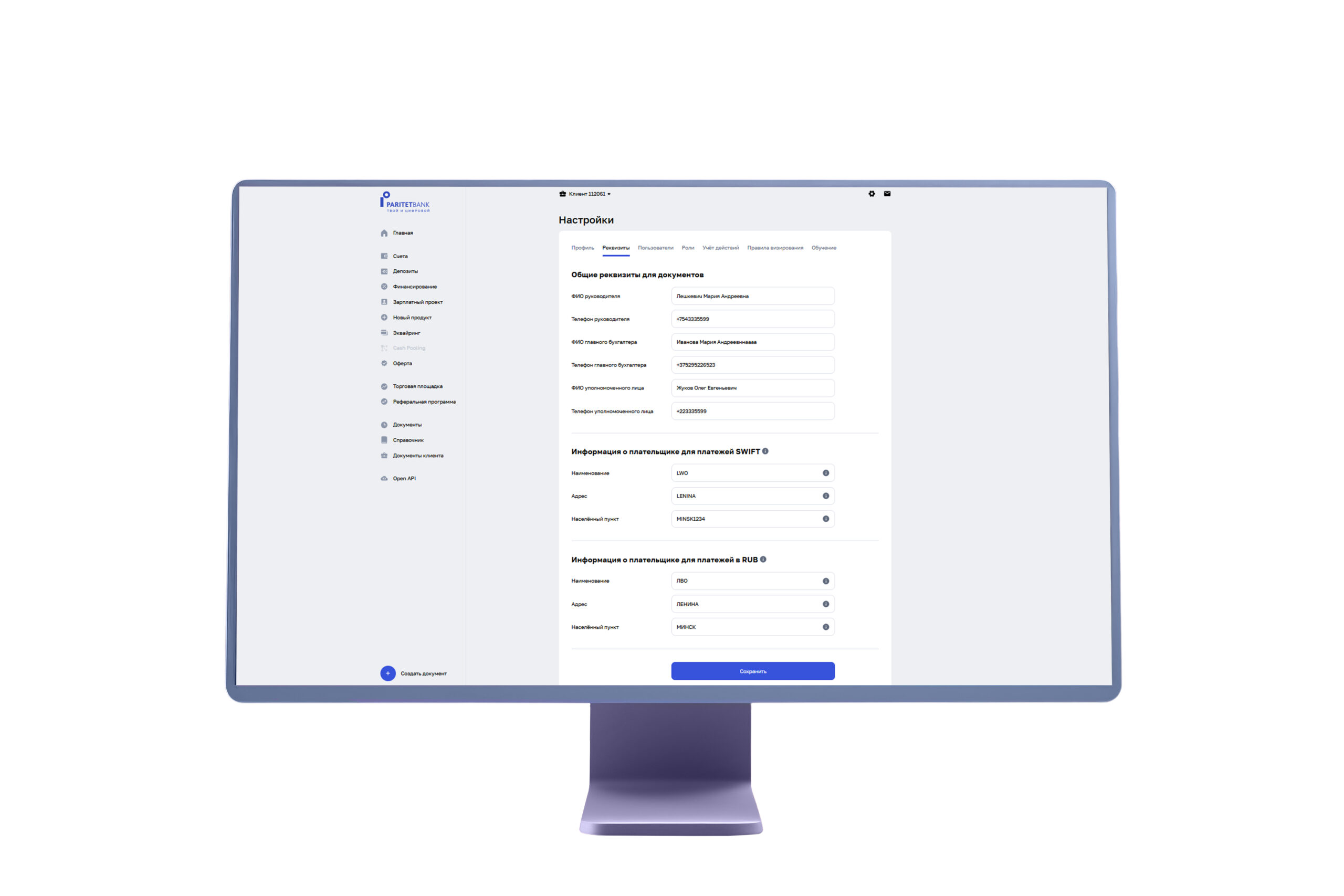

Settings:

User Rights & Management: Client-side user and role configuration

Document Workflow Roles: Assign roles for document handling

Approval (Authorization) Setup: Define signing rules before submitting to the bank

IP-Based Access Restrictions

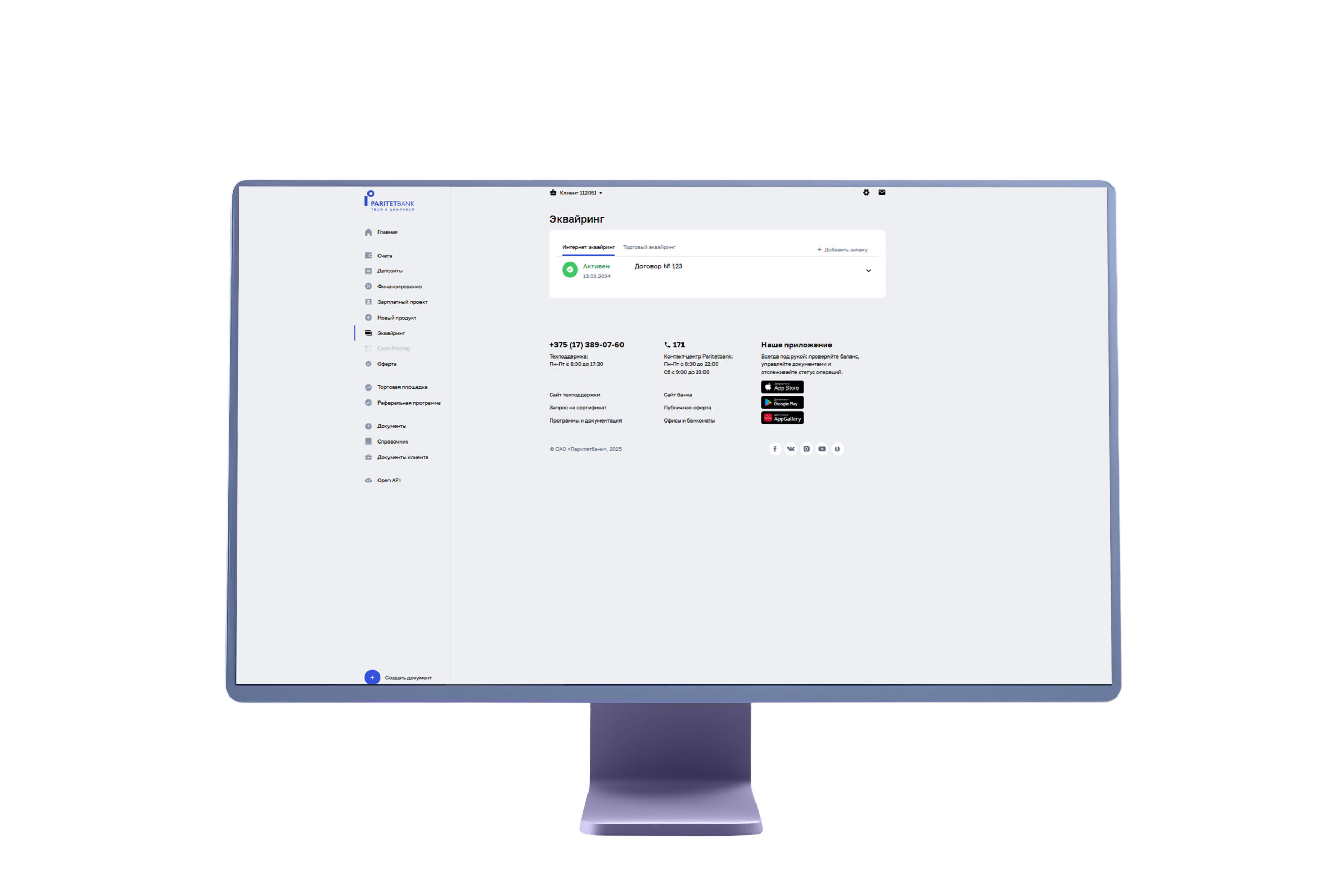

Internet Banking Acquiring:

Acquiring Agreement Management

Terminal Control

Terminal Statements

Report Generation

Dedicated Request Handling

Payroll Services:

Employee Directory: Manual entry or bulk import for card account deposits

Directory Management: Add, edit, or remove employee records

Payroll Processing: Apply directories for fund transfers

Dedicated Request Handling

Contract Management:

Bank-Side Contract Creation

Bank-Side Approval & Signing: Supports multiple users and signatures

Client-Side Signer Assignment: Designate authorized signatories

Secure Contract Delivery: Signed contracts sent via Internet Banking

Client Approval: E-signature or multi-factor authentication (MFA)

Transparent Tracking: View all approvers/signers (bank and client sides)

Key Features:

Remote Identification: Via State SUK EPKS digital certificate

End-to-End Digital Process: From registration to contract signing

Secure E-Signature Documentation

Open API Support

Integration with Popular Accounting Software

Want to discuss a joint project?

Be our partner and together we will achieve your expectations